Find Assisted Living in Your Area

Many older adults need some type of senior care, whether it’s a few hours per week of in-home help or full-time nursing home care. Even if you can find a high-quality senior living community in your area, the cost of care is a major concern, especially for seniors living on Social Security or limited pension benefits.

Due to high rates of inflation, senior care is getting even more expensive. According to the 2021 Genworth Cost of Care Survey, seniors in the United States pay an average of $4,500 per month for assisted living and $7,908 per month for a semiprivate room in a nursing home.

As a result, many seniors are selling their homes to finance the cost of the care they need to maintain their quality of life. The process of selling a home is complex, especially for older adults who need government benefits to cover some of their expenses. If you’re getting ready to help a parent sell their home, this guide can help you get organized and make wise decisions about everything from timing the sale to choosing an experienced attorney.

When Is the Right Time to Sell Your Parent's Home to Pay for Senior Care?

Timing is one of the most important considerations when it comes to selling your parent’s home to pay for senior care. If you wait too long to put the home on the market, it may take several months to sell it, leaving your family responsible for paying property taxes, utility bills and other expenses. Listing it too early can deprive your parent of the opportunity to remain in the home for as long as possible.

Before Senior Living

There are a few reasons you might want to sell the home before your parent is ready to move to a senior living community:

- They can no longer afford to cover mortgage payments, property taxes and other expenses.

- The supply of homes in your area far exceeds the demand, meaning you may need to wait several months to get an offer.

- Your parent plans to move in with you or another relative, leaving you with plenty of time to list the home and wait for someone to make a reasonable offer.

After Senior Living

In a few cases, it makes more sense to sell the home after your parent moves to a senior living community. Here are some examples:

- Your parent has Alzheimer’s disease or another form of dementia that would make selling the home difficult while they are still residing in it.

- You need to remodel the home or clear out years’ worth of clutter before you schedule any showings. It’s much easier to do cleaning and remodeling work if no one’s living in the home.

- Your parent doesn’t want to have to worry about tidying up or making themselves presentable every time someone wants to look at the house.

- Your parent was just discharged from a hospital or rehabilitation center and can’t return home without putting their health and safety at risk.

- You want to hire a home staging professional to decorate the house and make it more likely that you’ll get multiple offers above your asking price. It’s easier to stage a home after the occupant has moved out.

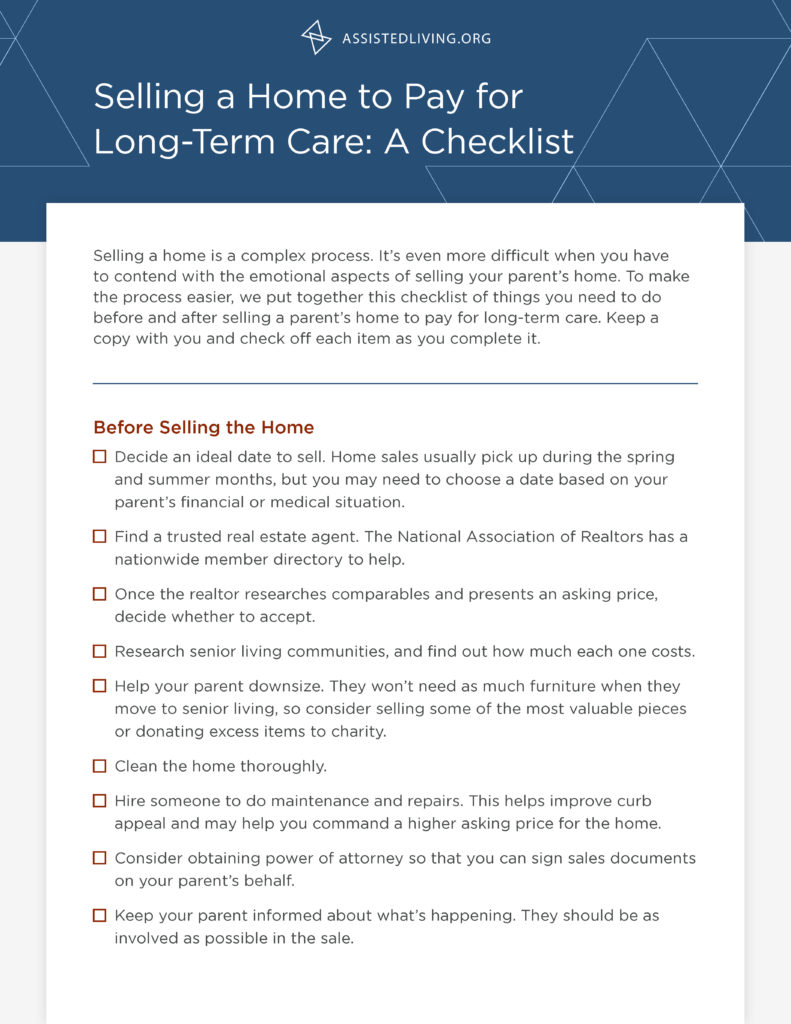

A Home Seller's Checklist

Without a detailed checklist of action items, it’s difficult to keep track of everything you need to do to put your parent’s home up for sale and attract potential buyers. The checklist below tells you exactly what you need to know to sell a home before or after a parent moves to senior living. Stay organized by checking off each item as you complete it. Click the checklist below to download.

Important Documents You Need to Sell a Home

Before you sell a home, you must prove that you have the right to sell it. If the home still has a mortgage on it, you also need to be able to pay off the mortgage with the proceeds from the sale. You may even need to communicate some important information about the home to the buyer or their attorney. For these reasons, it’s important to gather a variety of documents before you list the home for sale.

If you don’t already have access to these documents, you may need to request copies from lenders, title companies, law firms and other organizations, so give yourself as much time as possible to get everything together. Below you’ll find a list of must-have documents, as well as a list of documents you may need, to sell your parents’ home.

Must-Have Documents

You absolutely must have these documents before putting the house on the market:

- Original sales contract: The original contract confirms that your parent owns the home. It also includes details about the sales transaction, such as the date of the sale and whether the sale included any personal property left in the home by the previous owner.

- Home appraisal: An appraisal is a professional’s opinion of how much a home is worth. It’s important to get an appraisal before listing the home, so you can set an appropriate price. A home appraisal can also help you show buyers that the listing price isn’t out of the ordinary for your local real estate market.

Documents You May Need

You may also need the following documents to transfer ownership, pay off an existing loan or answer potential buyers’ questions about the home.

- Recent mortgage statement: If the home still has a mortgage, you’ll need the most recent mortgage statement to determine the payoff amount. This is the amount of money you’ll need to pay to satisfy the original terms of the loan and wipe out the debt completely.

- Past utility bills: Energy costs are an important consideration for potential buyers. If you have past electric, gas and water bills on hand, you can easily answer questions about average utility costs.

- Homeowners’ association (HOA) records: Potential buyers need to be aware of the HOA rules in your community. Having these documents on hand can also help you answer questions about HOA fees and special assessments.

- Maintenance records: Potential buyers may ask questions about when the HVAC system was last serviced or whether your parent ever paid for any pest control services. It’s easier to answer these questions if you have maintenance records available.

- Records related to capital improvements: Capital improvements are repairs or alterations that increase the value of a property, such as adding a new roof or putting on an addition. Having receipts for this type of improvement can help you sell the home for a higher price.

- Home warranties: A buyer may be more willing to invest in a home if it comes with warranties to cover the cost of unexpected repairs.

- Homeowners insurance documents: If your parent plans to move out before selling the home, you need to consult their homeowners insurance documents to find out if the insurer will continue providing coverage once the home is vacant. Even if the policy remains in effect, an insurance company may not pay claims related to vandalism and theft if the home is unoccupied for a long period of time.

Taxes, Medicaid Eligibility and Other Financial Implications of Selling a Home to Pay for Long-Term Care

Selling a home is a good way to raise funds for long-term senior care, but it may have some tax implications or affect your parent’s ability to qualify for Medicaid and other benefits. It’s important to understand the potential effects of a home sale on your parent’s finances before you put the house on the market. Here’s what you need to know about taxes, VA benefits and Medicaid eligibility.

Tax Implications

A capital gain is defined as the difference between your adjusted basis in the asset — the cost of an asset after accounting for increases or decreases in its original value — and the amount you earn from selling the asset. In some cases, you need to pay tax on this type of gain.

Short-Term Capital Gains

If you own a capital asset for less than 1 year before you sell it, any gain is typically considered a short-term gain. For federal tax purposes, short-term gains are taxed as ordinary income. That means they’re taxed just like wages from a job or income from operating a business. The United States has seven federal tax brackets ranging from 10% to 37%, so the amount of tax owed on a short-term capital gain depends on the seller’s current tax bracket.

Long-Term Capital Gains

If you own a capital asset for more than 1 year before you sell it, any gain is usually considered a long-term gain. The IRS treats long-term capital gains more favorably than short-term capital gains, capping the federal long-term capital gains tax at 15% for home sales. This 15% rate applies if a seller has income in the following ranges:

- Single filers: More than $40,400/less than or equal to $445,850

- Married filing jointly/qualifying widow(er): More than $80,800/less than or equal to $501,600

- Married filing separately: More than $40,400/less than or equal to $250,800

- Head of household: More than $54,100/less than or equal to $473,750

Exceptions to Long-Term Capital Gains Tax

The IRS does offer some exceptions to the long-term capital gains tax requirement. One of those exceptions applies if your parent owned the home and used it as a primary residence for at least 2 out of the last 5 years before selling. For this exception to apply, the capital gain can’t exceed $250,000 ($500,000 for married couples).

If your parent had to move to a senior living community because they couldn’t care for themselves at home, they may still qualify for the exception if they lived in the house for at least 12 months during the 5-year period. Time spent in the senior living facility may count toward the residency requirement, as long as the facility is licensed by the state or another appropriate entity.

Your parent may also be exempt from long-term capital gains tax if their annual income falls below $40,400 (single) or $80,800 (married filing jointly/qualifying widow/qualifying widower).

State Tax Considerations

The tax rates and exceptions described above apply to federal taxes only. Your state may have its own rules regarding long-term capital gains tax, so it’s wise to consult a certified public accountant or tax attorney to determine the potential tax implications of selling your parent’s home. For example, California treats all capital gains like ordinary income, whether they’re short-term or long-term in nature. This can make a big difference when it comes to preparing to sell a home.

Veterans’ Benefits

If your parent receives a pension from the Department of Veterans Affairs (VA), selling their home can have a major impact on their ability to continue receiving benefits. VA pensions are much different from the defined-benefit pensions offered by some employers, as eligibility depends on a veteran’s net worth. For 2022, the net worth limit for VA benefits is $138,489.

Calculating Net Worth

The VA calculates a veteran’s net worth based on their annual income and assets. For married veterans, spousal income counts toward the limit. Annual income includes the following:

- Wages/salary

- Commissions

- Bonus

- Tips

Assets include the fair market value of all real estate and personal property owned by the veteran, such as cash, furniture, jewelry and money in savings, checking and investment accounts. The VA doesn’t count a veteran’s primary residence, vehicle or basic appliances toward the net worth limit.

This is why selling a home has major financial implications for older adults who need the money to pay for long-term senior care. As long as your parent owns the home, it doesn’t count toward the net worth limit to receive VA benefits. Once the home is sold, however, any proceeds from the sale are considered countable assets. As a result, selling a home may make your parent ineligible for VA pension benefits.

Medicaid Eligibility

Medicaid covers some types of long-term care, making it an important program for many seniors. To qualify for Medicaid, an applicant must meet certain financial requirements, one of which is the home equity limit for certain Medicaid programs.

As of July 2022, 37 states have home equity limits of $636,000, the federal minimum. Another 11 states use the federal maximum, which is $955,000. These limits apply to individuals applying for nursing home Medicaid or one of Medicaid’s Home and Community-Based Services (HCBS) waiver programs. There’s no home equity limit for applicants to the Medicaid Aged, Blind and Disabled (ABD) program.

The Medicaid Look-Back Period

If the amount of equity in your parent’s home exceeds the limit for nursing home Medicaid, selling the home may seem like an obvious solution. Unfortunately, it’s not always that simple, as Medicaid has a look-back period to make sure applicants don’t give away their assets or sell assets for less than their fair market value just to meet the financial eligibility requirements.

In 49 states and Washington, D.C., the look-back period covers the 5 years prior to an individual’s Medicaid application date. California has a look-back period of just 30 months. There’s no look-back penalty if you sell your parent’s home for its fair market value (FMV); however, the proceeds from the sale are likely to push your parent over the asset limit for Medicaid, rendering them ineligible for coverage.

Calculating the Look-Back Penalty

If your parent violated the look-back rules by giving away their home or selling it for less than its FMV within the previous 5 years (30 months for California), Medicaid will determine a period of ineligibility based on the average cost of nursing home care in their state. Here’s an example:

Assume your parent lives in Florida, which has a penalty divisor of $9,703 per month. During the look-back period, they sold their home for $50,000 less than its FMV. The Florida Medicaid program would divide the disqualifying transfer of $50,000 by the penalty divisor of $9,703, resulting in an ineligibility period of a little more than 5.15 months.

Special Considerations When Selling the Home of Someone Who Has Dementia

Typically, the legal owner is the only person who can sell a piece of real estate. However, someone with dementia or another form of cognitive decline may not have the capacity to enter into a sales contract, which means you may need to make arrangements to make decisions on their behalf. Power of attorney and guardianship are two of your options.

Power of Attorney

Financial power of attorney gives someone the authority to manage another person’s financial affairs. If your parent gives you power of attorney, you’ll be able to perform a wide range of tasks, including selling assets, managing bank accounts, paying bills and filing annual tax returns. It’s important to arrange for POA as soon as possible after a dementia diagnosis, as your parent won’t be able to sign the documents if the disease is advanced enough to render them unable to make their own legal decisions.

Guardianship

Guardianship is more complex than power of attorney, making it more expensive and time-consuming. When an older person can’t make their own decisions, a judge appoints a guardian to manage their legal affairs and a conservator to manage their financial affairs. In many cases, the guardian and the conservator are the same person, but it doesn’t have to be that way. If you have a trusted sibling, for example, it’s possible for one of you to serve as guardian and the other to act as conservator.

If the court appoints you as your parent’s guardian, you have a fiduciary responsibility, which means you need to act in your parent’s best interests and not your own. As a guardian, you also have a duty to the court. In a full guardianship, the appointed guardian can make almost any decision on the older person’s behalf. Limited guardianships are more restrictive, as the guardian is only allowed to make decisions as outlined in a court order.

Managing Difficult Emotions When Selling a Parent's Home

Emotions often run high when an older person has to sell their home to pay for senior care. Your parent may be upset about leaving their memories behind or giving up some of their independence. It can also be stressful to think about having to downsize and sell or give away cherished possessions. If you lived in the home as a child, you may find yourself getting upset as you start decluttering and prepare to help your parent move to a senior living community.

Nothing will take these emotions away completely, but there are a few things you can do to make the process easier for everyone.

- Plan ahead: Few things are as stressful as having to pack up a lifetime of furniture, clothing, decorative items and other possessions in just a few weeks. Reduce stress by encouraging your parent to keep their home organized. If possible, offer to help your parent declutter and eliminate items that are broken, outdated or just not used very often.

- Get organized: Once you decide to sell, stay as organized as possible. Come up with a simple system for marking items to sell, donate or throw away. If possible, take items to your local donation center once or twice a week, so you don’t have to take multiple carloads right before the sale closes.

- Take time to reminisce: Try not to rush your parent, even if there’s a limited amount of time for them to downsize and move. As you go through the house, set aside time to look at photo albums or reminisce about the happy memories you’ve all had in the home.

- Remind your parent why they’re moving: Talk with your parent about how moving to a senior living community will make their life better. They won’t have to pay for home repairs, spend their free time cleaning or worry about lawn maintenance or snow removal. They’ll also have opportunities to make new friends and attend fun social events.

Be open and honest: Be patient and respectful with financial matters — it’s important to be transparent. Include your parent in important decisions, such as setting a listing price or determining which offer to accept. Make sure they’re aware of any price cuts or other changes to the listing once it goes live.

Other Ways to Finance Long-Term Care

If selling your parent’s home isn’t an option, or you don’t make enough of a profit to cover the full cost of care, there are several other options. Bridge loans and immediate annuities can be paired with a home sale to increase the amount of money available for senior care. You may also be able to use government benefits or other financial products to finance long-term care for your parent.

Bridge Loans

A bridge loan allows your parent to tap into their home equity to pay for senior care before the sale closes. Equity is the difference between what the home is worth and how much is left on the mortgage. For example, if your parent’s home is worth $300,000 and the mortgage has a $130,000 balance, then your parent has $170,000 in home equity.

To qualify for a bridge loan, your parent must have at least 20% equity in their home. For a home valued at $300,000, as in the example above, that’s at least $60,000. Bridge loans are short-term loans, so they typically have terms of 6 to 12 months. If you already have an offer and just haven’t closed the deal yet, a bridge loan can help you finance senior care until you can work out all the details.

You may not want to get a bridge loan unless you’re fairly confident the sale will close before the loan term comes to an end. Otherwise, you’ll have to repay the loan without any proceedings from the home sale. Another disadvantage of bridge loans is that they usually have higher rates than mortgages. A typical interest rate is anywhere from 8.5% to 10%.

Immediate Annuities

With an immediate annuity, you make a lump-sum investment and then receive income payments in return. Once you make the initial investment, you typically receive your first income payment right away, which is why these annuities are called “immediate.” When you sell the home, you can use some of the proceeds to purchase an annuity contract and then use the income payments to pay for senior care.

If you invest in a variable annuity, your income payments depend on how well the market performs. Fixed annuities offer a little more stability, as your income payments are always the same. During market downturns, this can help you keep your income steady; if the market is doing well, however, you’ll miss out on higher payments.

The pros of immediate annuities are as follows:

- They’re easy to manage.

- You receive monthly payments.

- You start receiving income payments right away.

- If you choose a fixed annuity, you can avoid losing money during market downturns.

Immediate annuities also have the following disadvantages:

- Immediate annuities require a high initial investment.

- It’s expensive to break an annuity contract if your parent has an emergency and needs their initial investment back.

- After several years, the income payments may not be worth as much due to inflation.

Other Financial Assistance Alternatives to Pay for Senior Care

| Option | Contact Information | Description |

| Medicaid | Contact the Medicaid agency for your state. | – Medicaid covers nursing home care for eligible applicants.

– Waiver programs are available that may cover the cost of other types of senior care. |

| VA Pension Benefits | (800) 827-1000 | – Veterans with no dependents receive benefits worth $14,753 to $24,610 per year, depending on their eligibility category.

– The maximum benefit amount is adjusted regularly to account for cost-of-living increases. |

| HUD FHA Reverse Mortgages | Call (800) 569-4287 to speak with a reverse mortgage counselor. | – A reverse mortgage allows a homeowner to borrow against their home equity.

– Your parent can use the funds from a reverse mortgage to pay for senior care. – The balance of the loan becomes due as soon as the borrower moves out of the home. |

| Long-Term Care (LTC) Insurance | Contact your preferred insurance company or call your state insurance commissioner’s office for more information on long-term care policies. | – LTC insurance reimburses a covered individual for some of the costs of long-term care.

– LTC insurance premiums are typically very costly, so this type of insurance is for people with considerable wealth looking for protection. – It’s important to buy LTC insurance as early as possible, as your parent may be denied if they’re in poor health or already need long-term care. |

How to Find a Real Estate Agent and Elder Law Attorney

It’s helpful to work with a real estate agent and an elder law attorney to make sure everything is in order before you put your parent’s home on the market. A realtor can help you determine an appropriate listing price and make suggestions for home improvements and home staging to help you maximize the profit on the sale. An elder law attorney can draft power of attorney documents, help you get guardianship or advise you on a wide range of other elder law issues.

To find an experienced real estate agent, use the National Association of REALTORS member directory. The National Academy of Elder Law Attorneys also has a tool for locating elder law attorneys in your area.